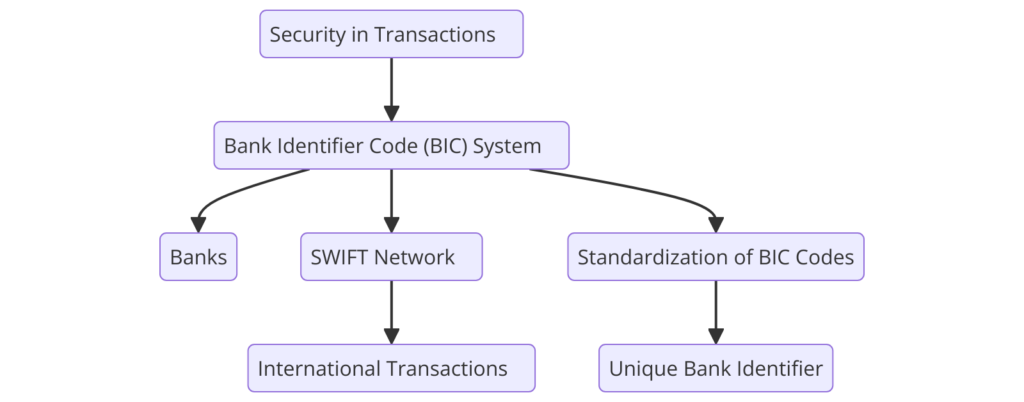

In today’s globalized banking environment, financial transactions must be executed seamlessly across borders. The ISO 9362:2022 Bank Identifier Code (BIC) system plays an important role in ensuring that these transactions are processed efficiently and securely. It acts as a unique identifier for banks and financial institutions, allowing them to communicate and facilitate transactions worldwide without errors.

ISO 9362:2022 is the latest revision of the ISO 9362 standard, which specifies the structure and guidelines for the BIC system. This standard ensures that financial institutions can be uniquely identified, streamlining international transactions and boosting trust between banking entities globally.

The BIC, often referred to as a SWIFT Code, is integral to the modern banking infrastructure. It is used not only for international wire transfers but also for exchanging secure messages between banks and other financial institutions. Let’s explore the specifics of ISO 9362, its requirements, benefits, and how Pacific Certifications can help your institution achieve compliance and certification.

Understanding ISO 9362:2022 and Its Key Components

The ISO 9362 standard provides a structured framework for assigning Bank Identifier Codes (BICs). Each BIC is an 8 to 11-character alphanumeric code that identifies a specific bank or financial institution. The standard defines how these codes are assigned, ensuring consistency and global recognition.

A BIC is structured as follows:

- The first four characters represent the bank code.

- The next two characters denote the country code.

- The following two characters are the location code.

- The final three characters (optional) signify a branch code.

For example, a BIC like “BOFAUS3NXXX” refers to:

- BOFA: The bank code for Bank of America.

- US: The country code for the United States.

- 3N: The location code.

- XXX: Optional branch code indicating the head office.

ISO 9362 is an essential update to this long-standing standard, incorporating changes and adjustments to reflect current banking and financial environments. These updates ensure that BICs continue to serve as a reliable tool for international banking operations, maintaining consistency and accuracy.

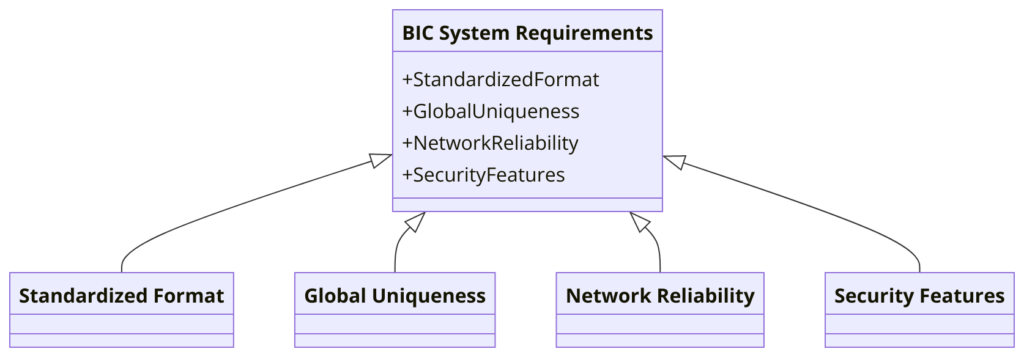

What Are the Requirements of ISO 9362:2022?

To comply with ISO 9362:2022, financial institutions must meet specific requirements in terms of how they generate, assign, and manage their BICs. The standard focuses on several key areas:

Unique Identification

- Every financial institution must have a unique BIC that adheres to the structure defined by ISO 9362. This ensures there are no duplications or errors when processing international financial transactions.

Global Recognition

- The BIC must be recognized globally, meaning it must comply with the standard’s guidelines to ensure uniformity across different countries and banking systems.

BIC Assignment and Registration

- Institutions are required to follow the process for BIC assignment, ensuring that codes are generated systematically and assigned appropriately. Registration with the appropriate authority, such as SWIFT (the Society for Worldwide Interbank Financial Telecommunication), is also crucial for global use.

Data Integrity

- ISO 9362:2022 places emphasis on maintaining data integrity within the BIC system. Institutions must ensure that their codes are up-to-date and that they manage their BICs effectively, keeping all information accurate and reliable.

Security

- The standard also highlights the importance of security when using the BIC system. Financial institutions must take measures to protect their codes and ensure that they are not used fraudulently or incorrectly.

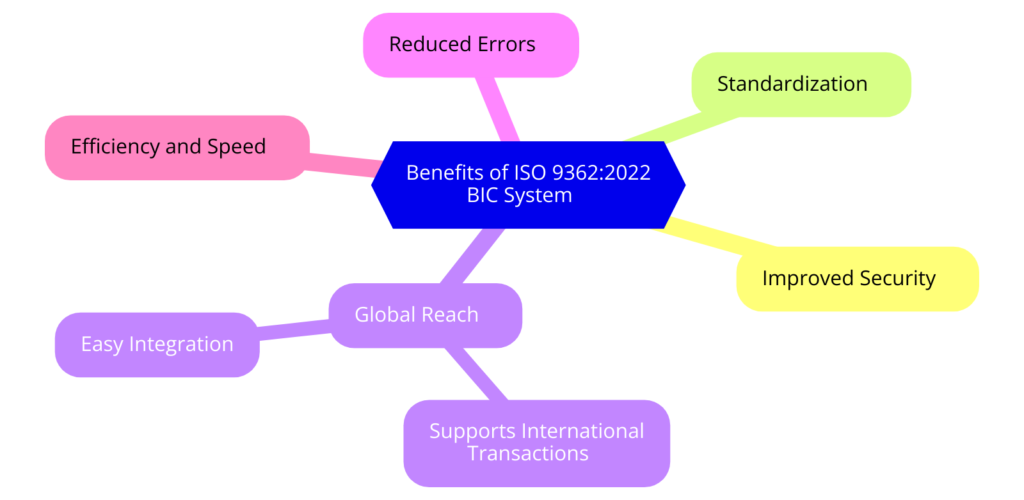

What are the Benefits of ISO 9362:2022

Achieving compliance under ISO 9362:2022 offers numerous advantages for financial institutions. Here’s why certification is critical for banks and other financial entities operating internationally:

- Having an ISO 9362:2022-certified BIC system assures your clients and other institutions that your operations meet international standards.

- A standardized BIC ensures that international transactions are processed smoothly. It minimizes errors and miscommunication during money transfers.

- Certification under ISO 9362:2022 helps with a clear, structured BIC system in place, your institution can process transactions more quickly and with fewer mistakes.

- Many countries and financial authorities require banks to use BICs that comply with international standards. By certifying under ISO 9362:2022, you ensure compliance with these regulations, avoiding potential legal issues and penalties.

- The ISO 9362 Certification ensures that your institution has the necessary controls in place to protect against fraud and data breaches, safeguarding both your organization and your clients.

- ISO 9362:2022 certification sets your institution apart from competitors. It signals to clients and partners that you are committed to maintaining high standards of reliability and accuracy.

Who Needs ISO 9362:2022 Certification?

ISO 9362:2022 is vital for a wide range of organizations within the financial sector, particularly those involved in cross-border financial transactions. Here are some of the key institutions that benefit from this certification:

Banks

- Whether dealing with international transfers or communicating with foreign financial institutions, banks rely heavily on the BIC system. ISO 9362:2022 certification ensures that their systems are up to the highest global standards.

Credit Unions

- As credit unions expand their services internationally, they must adopt standardized systems like BIC to facilitate seamless transactions with other financial entities.

Investment Firms

- Investment firms managing international portfolios require accurate and efficient systems to handle cross-border financial exchanges. The ISO 9362 certification helps ensure their processes meet global standards.

Payment Processors

- Companies involved in processing international payments need BICs that are recognized worldwide to avoid transaction errors. Certification ensures these BICs meet ISO standards.

Foreign Exchange Brokers

- Forex brokers operate across multiple markets, necessitating a reliable and standardized identifier like the BIC to communicate and transact with foreign banks and financial institutions.

How Pacific Certifications Can Help with ISO 9362:2022 Certification

At Pacific Certifications, we understand the critical role that ISO 9362 plays in the global financial landscape. As an accredited certification body, we provide robust and comprehensive services to help financial institutions comply with the requirements of the ISO 9362:2022 standard.

Our services include the following:

Audit and Certification Process:

- We conduct thorough audits of your organization’s BIC system to ensure that it adheres to all the requirements of ISO 9362:2022. Our audit process is designed to be rigorous yet efficient, minimizing disruption to your operations while ensuring complete compliance.

Experienced Auditors:

- Our team of experienced auditors is well-versed in the intricacies of ISO standards and the specific demands of the financial industry. We work closely with your institution to identify areas of improvement and ensure that your BIC system meets the highest standards of accuracy, reliability, and security.

Global Recognition:

- With certification from Pacific Certifications, your organization’s BIC system will be recognized internationally, giving you credibility in the global market. Our certification is trusted by financial institutions worldwide, helping you build stronger partnerships and client relationships.

Ongoing Support:

- Once certified, we provide ongoing support to ensure that your institution continues to meet the requirements of ISO 9362:2022. We offer surveillance audits to maintain your certification and ensure that your BIC system remains compliant with the latest updates to the standard.

At Pacific Certifications, we are committed to helping your financial institution achieve compliance and gain the recognition it deserves through ISO 9362:2022 certification. Our audit and certification services are tailored to meet the specific needs of the financial sector, providing you with a reliable, secure, and globally recognized certification solution.

FAQs: Frequently Asked Questions

ISO 9362:2022 defines the structure and guidelines for assigning Bank Identifier Codes (BICs) to financial institutions, ensuring they can be uniquely identified for international transactions

Financial institutions, including banks, credit unions, payment processors, and investment firms, that engage in cross-border transactions and need a globally recognized identifier.

It streamlines communication between banks, minimizes transaction errors, and enhances the security of financial exchanges globally.

Pacific Certifications provides certification services to ensure your financial institution’s BIC system complies with the ISO 9362 standard.