What is ISO 20022?

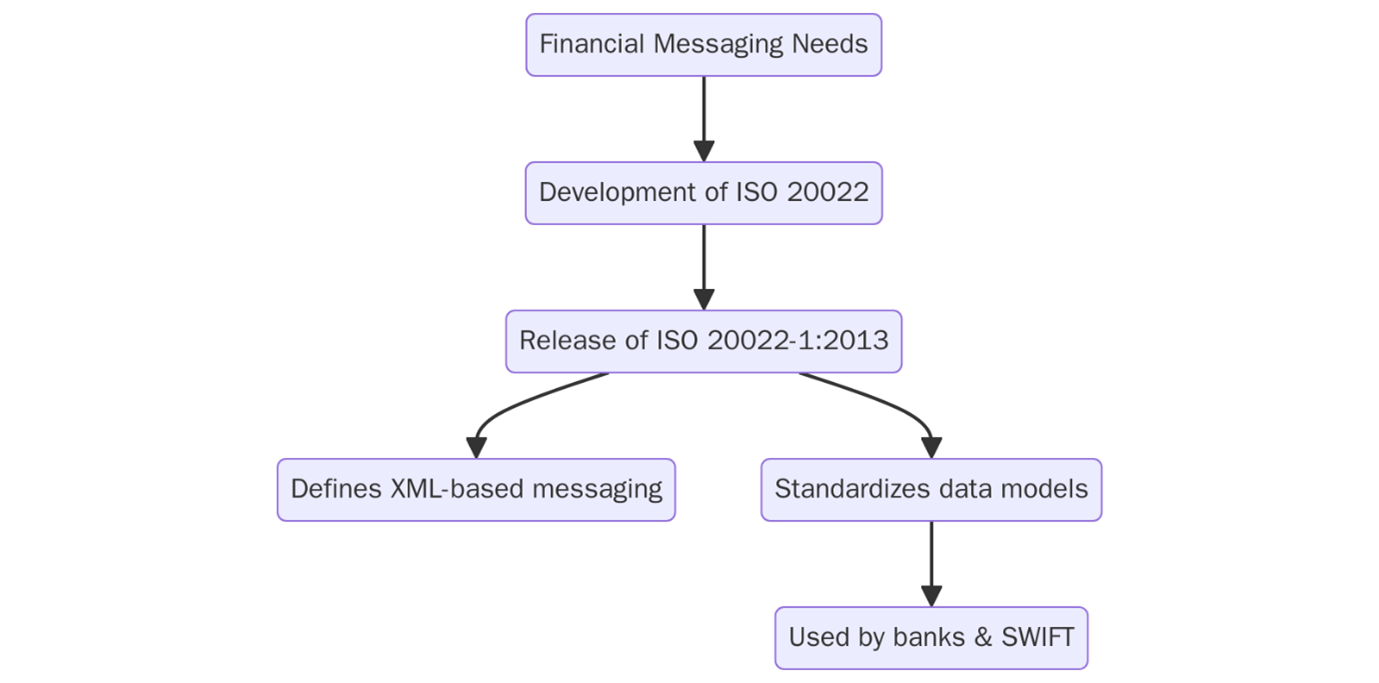

ISO 20022-1:2013 is the first part of the standard series that establishes a universal messaging methodology for financial services. Part 1 defines the metamodel, which forms the foundational framework for modeling business processes and data across banking, securities, payments, foreign exchange and trade services.

The metamodel serves as a conceptual blueprint for structuring financial messaging in a consistent and technology-neutral format. It ensures that different financial institutions and market infrastructures, despite differing systems or platforms can exchange standardized and semantically precise messages.

With global initiatives such as SWIFT’s migration to ISO 20022 and regulatory pushes by ECB, Fedwire, CHAPS, and TARGET2, is now a strategic cornerstone of global financial messaging modernization.

Need help understanding or aligning with this standard? Contact us at support@pacificcert.com!

Scope and Applicability

ISO 20022-1:2013 applies to:

- Banks and financial institutions developing messaging platforms

- Payment service providers migrating from legacy formats like MT to MX

- Central banks and clearing houses implementing real-time gross settlement (RTGS) systems

- Standards bodies and developers building messaging APIs for cross-border interoperability

- Regulatory and compliance entities integrating structured data into reporting and oversight

This part of the standard provides a shared syntax and semantic structure for modeling all business transactions before converting them into XML schemas or other syntax for message exchange.

If your systems rely on structured financial messaging, this standard is foundational.

Series Structure (Overview)

The ISO 20022 standard is composed of multiple parts:

Part | Title |

1 | Metamodel |

2 | UML Profile for ISO 20022 |

3 | Modeling Rules |

4 | XML Schema Generation Rules |

5 | Reverse Engineering Rules for Messaging |

6 | Message Transport Characteristics |

Part 1, the metamodel, underpins all other parts by defining the logical relationships and modeling conventions between business processes, components, and messages.

To know more, contact us at suopport@pacificcert.com!

Purpose of the Metamodel

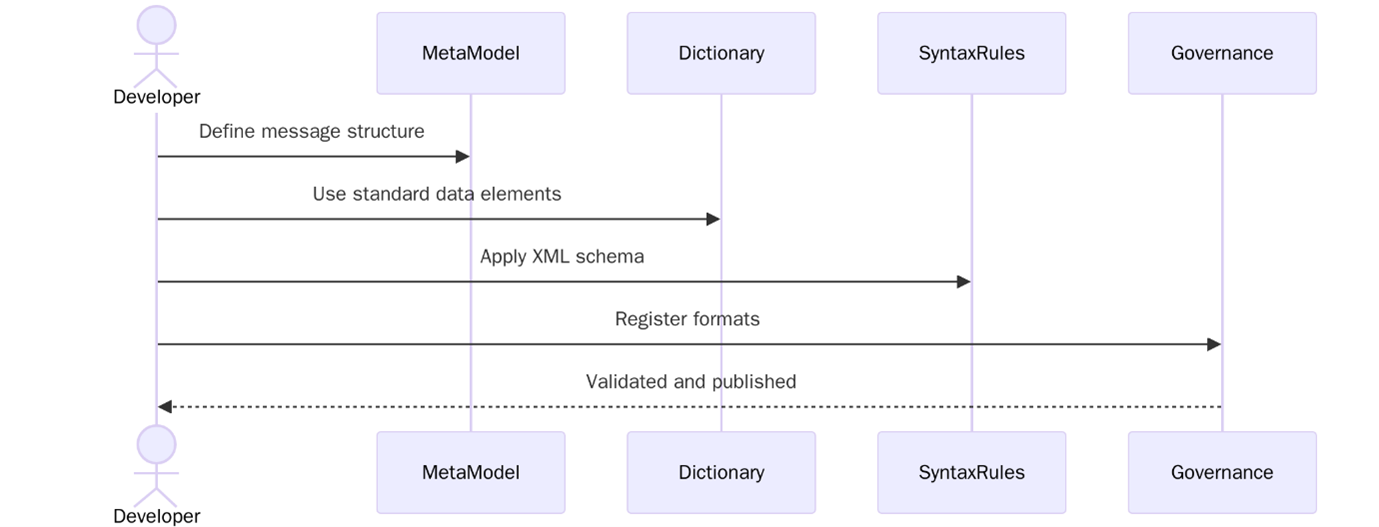

The ISO 20022 metamodel provides a standardized way to represent financial business processes and message content. It includes abstract models and formal relationships between concepts such as:

- Business transactions

- Actors (e.g., banks, clearing houses)

- Message components (e.g., payment instruction, trade confirmation)

- Reusable data types and elements

- Associations, flows, and constraints

This allows diverse systems to build messages with harmonized data structures, regardless of geography, language, or platform.

Metamodel-driven design ensures:

- Semantic clarity

- Data consistency across message types

- Platform independence

- Future-proof messaging evolution

Key Concepts

- Business Component Model

Defines core financial components such as accounts, parties, and transactions that are reused across domains (e.g., payments, securities, trade finance).

- Message Component Model

Maps business components to logical message structures for communication between systems.

- Data Type Model

Specifies standard formats (date, currency, identifier) to ensure consistency across fields and validation rules.

- Behavioural Model

Outlines the sequence and interaction of messages in business processes, including triggering events and outcomes.

- Class Diagram Representation (UML)

Uses the Unified Modeling Language (UML) to graphically define relationships, making message creation easier for developers and standards bodies.

Need help modeling messages using metamodel? Contact us at support@pacificcert.com.

Implementation Approach

Implementing ISO 20022-1:2013 begins with understanding your organization’s messaging needs and existing infrastructure. Institutions should:

- Map current message formats (SWIFT MT, proprietary formats) to ISO 20022 components

- Use the Repository (via SWIFT) to extract standard definitions and modeling structures

- Develop or update business process models using the metamodel

- Train developers, compliance, and business analysts on UML and metamodel concepts

- Align message generation tools with syntax and structure

For large banks or payment service providers, implementation is often done in phases, starting with high-value payments or regulatory reporting, then expanding to securities and trade finance.

Documentation Required

When implementing ISO 20022-1:2013, organizations should maintain:

- Business process models based on ISO 20022 structure

- Mapping documents between legacy and message formats

- Internal modeling guidelines and tools

- UML models of financial transactions and data flows

- System design and message validation frameworks

- Testing procedures and sandbox simulations

- Compliance evidence for central banks or regulators

Need a documentation framework? We offer templates and guidance—email support@pacificcert.com.

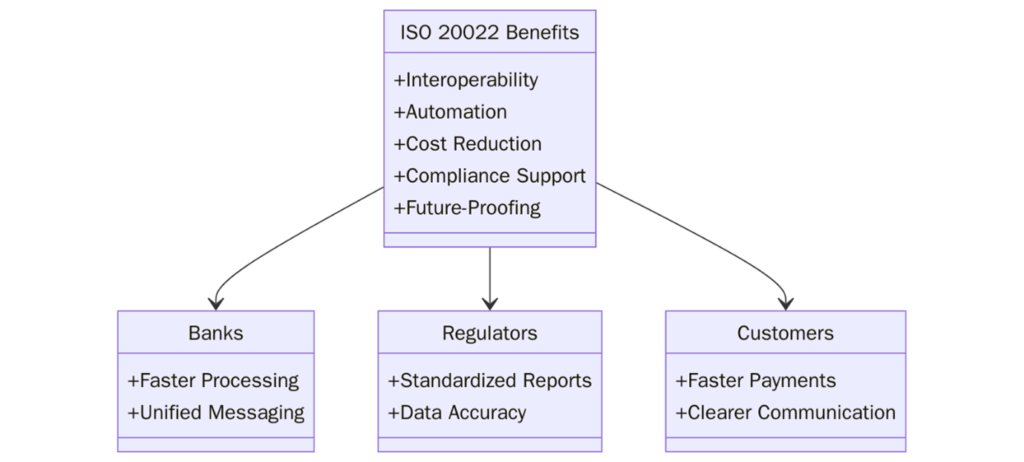

Benefits of ISO 20022

- Facilitates cross-border messaging across banks, payment systems, and market infrastructures.

- Structured semantics prevent misinterpretation, especially in automated systems.

- Designed to support evolving regulatory and technological needs (e.g., instant payments, open banking).

- Compared to legacy formats (like SWIFT MT), enables extended remittance data and regulatory fields.

- Structured formats simplify KYC, AML, and real-time compliance reporting.

- Reduces errors, manual interventions, and reconciliation time in financial processing.

- ISO 20022 is the foundation of RTGS modernization by ECB (TARGET2), Bank of England (CHAPS), and Fedwire.

It has become the global standard for financial messaging, with adoption accelerating across:

- Global RTGS systems: CHAPS (UK), TARGET2 (EU), FedNow and Fedwire (USA), RITS (Australia)

- SWIFT network: Migration from MT to MX messages now mandatory for cross-border payments

- Open banking and APIs: Fintechs and banks using data models for seamless integration

- Regulatory mandates: Basel III, FATF, and other compliance frameworks prefer structured, ISO-standardized reporting formats

According to SWIFT, over 80% of global high-value payments will be ISO 20022-compliant by mid-2025.

Want to ensure your systems are ready? Reach us at support@pacificcert.com.

How Pacific Certifications Can Help?

We offer tailored support for financial institutions implementing ISO 20022 standards:

- ISO Metamodel workshops and training

- Business process modeling using UML tools

- Messaging format migration and gap assessments

- Documentation support and regulatory alignment

- Testing and validation frameworks for ISO implementation

- Alignment with ISO/IEC 20000 (IT Service Management) and ISO 22301 (Business Continuity)

From national banks to fintech startups, we help make ISO 20022 implementation successful and sustainable.

Begin your journey with our expert team—contact support@pacificcert.com!

FAQ on ISO 20022

Is ISO 20022 mandatory?

While not mandatory globally, many central banks and financial networks have made ISO 20022 adoption mandatory.

What is the ISO 20022 metamodel?

It is the conceptual structure used to model all ISO 20022-compliant financial messages in a consistent and interoperable way.

Can it be implemented independently of other ISO standards?

Yes, but it is often implemented alongside messaging tools, regulatory systems, and service frameworks.

Is ISO 20022 the same as XML messages?

No. XML is one syntax. ISO 20022 defines the semantic and logical model. Messages can also be implemented in JSON or other syntaxes.

How do I access ISO 20022 messages and schemas?

Through the official ISO 20022 Repository hosted by SWIFT.

Ready to get ISO 20022 certified?

Contact Pacific Certifications to begin your certification journey today!

Suggested Certifications –

Read more: Pacific Blogs