ISO Certifications for Commercial Motor Vehicle Insurance Services Businesses, Requirements and Benefits

Commercial motor vehicle insurance services are a cornerstone of modern transportation and logistics industries. From fleet management companies to insurance providers, ensuring efficiency and regulatory compliance is a priority. ISO certifications provide organizations with structured frameworks to enhance service quality, safety & customer satisfaction.

The International Organization for Standardization sets global standards across a variety of industries. These standards are designed to help organizations meet customer expectations and improve operational performance. ISO certifications also enable organizations to demonstrate their commitment to sustainability, safety and continuous improvement.

Send us your inquiries and requirements at support@pacificcert.com, and our team will respond promptly with all the details you need to kick-start the ISO certification process.

Applicable ISO Standards for Commercial Motor Vehicle Insurance Services

Understanding the relevant ISO standards is essential for commercial motor vehicle insurance providers. Below is a detailed overview of the key ISO standards applicable to this sector:

ISO 9001: Quality Management Systems (QMS): ISO 9001 focuses on quality management principles, ensuring that an organization consistently meets customer expectations and enhances customer satisfaction. For motor vehicle insurers, this translates into streamlined claims processing, accurate policy underwriting, and effective communication channels.

ISO 27001: Information Security Management Systems (ISMS): Given the sensitive nature of client data in the insurance sector, ISO 27001 certification is crucial. It provides a framework for managing information security risks and implementing best practices to safeguard data against breaches or cyber threats.

ISO 31000: Risk Management: Insurance services revolve around risk assessment and mitigation. ISO 31000 offers guidelines to develop robust risk management strategies, allowing companies to identify, evaluate, and address potential risks effectively.

ISO 22301: Business Continuity Management Systems (BCMS): In the event of disruptions, such as natural disasters or cyberattacks, ISO 22301 ensures that business operations can continue without significant downtime. For insurers, this is especially important to maintain uninterrupted service for clients.

ISO 14001: Environmental Management Systems (EMS): Environmental sustainability is becoming increasingly relevant in the insurance industry. ISO 14001 helps organizations manage their environmental impact, reduce waste, and promote eco-friendly practices.

ISO 45001: Occupational Health and Safety Management Systems: Ensuring the safety and well-being of employees is a critical focus for insurance companies. ISO 45001 establishes a framework to identify workplace hazards and implement measures to improve employee health and safety.

ISO 19600: Compliance Management Systems: Commercial motor vehicle insurers must adhere to a variety of regulatory requirements. ISO 19600 provides guidelines for establishing a compliance management framework that aligns with legal and ethical obligations.

Click here to find out more applicable standards to your industry

At Pacific Certifications, we specialize in conducting audits and issuing ISO certifications for commercial motor vehicle insurance services. Our team of experienced auditors ensures that your organization complies with the applicable ISO standards, providing you with the certification needed to build trust and credibility in your industry.

We understand the unique challenges faced by motor vehicle insurers, and our certification process is tailored to address these needs. By partnering with Pacific Certifications, your organization can achieve international recognition for excellence in quality and risk management.

Have a question outside office hours? Send us an email at support@pacificcert.com, and we’ll ensure to get back to you as soon as possible.

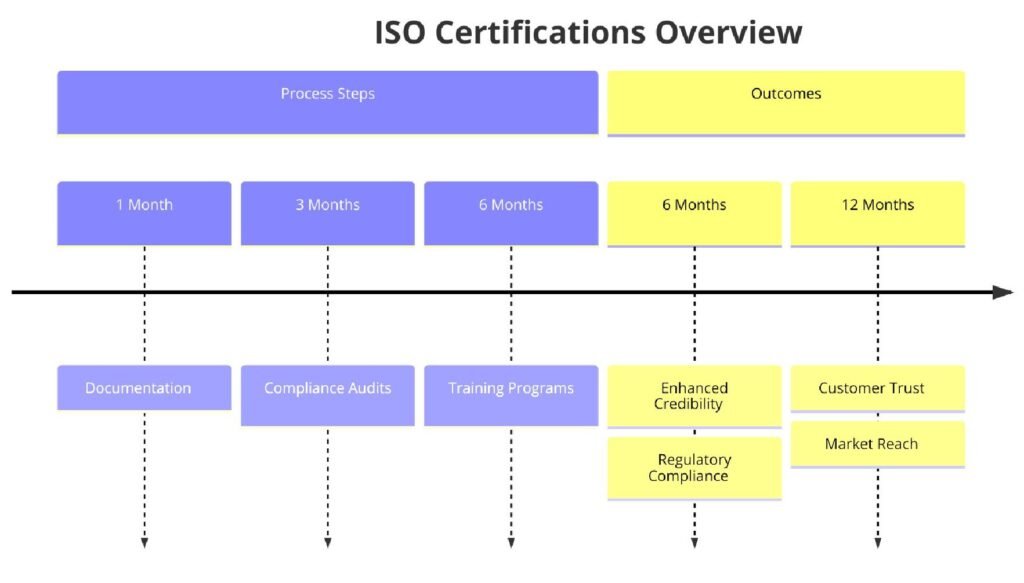

Requirements of ISO Certifications for Commercial Motor Vehicle Insurance Services

ISO standards have become indispensable for organizations in the commercial motor vehicle insurance sector. They provide structured frameworks that ensure quality and compliance with global benchmarks. Below are the step-by-step requirements of the most relevant ISO standards for commercial motor vehicle insurance services.

ISO 9001: Quality Management Systems (QMS)

- Establishment of a Quality Management System: Insurers must develop and implement a comprehensive Quality Management System (QMS) that aligns with ISO 9001 principles, including customer focus and continual improvement.

- Documented Policies and Procedures: Organizations are required to create and maintain detailed documentation of processes such as claims management, underwriting, and client communications.

- Performance Monitoring: Regular monitoring and measurement of key performance indicators (KPIs) are necessary to track the effectiveness of processes.

- Leadership Commitment: Top management must demonstrate leadership and commitment to quality management by allocating resources and setting quality objectives.

- Customer Satisfaction Monitoring: Insurers must regularly assess and improve customer satisfaction by collecting feedback and addressing complaints effectively.

- Internal Audits: Organizations must conduct internal audits to ensure compliance with their QMS and identify areas for improvement.

ISO 27001: Information Security Management Systems (ISMS)

- Information Security Risk Assessment: Organizations must identify risks to information security, assess their potential impact, and implement appropriate controls to mitigate them.

- Information Security Policies: Documented policies and procedures must be established to govern data handling, storage, and access.

- Access Controls: Organizations must implement measures to restrict access to sensitive data based on job roles and responsibilities.

- Encryption and Backup Solutions: Data must be encrypted to prevent unauthorized access, and backup systems must be established to ensure data recovery in case of loss.

- Regular Security Audits: Insurers must conduct periodic audits to evaluate the effectiveness of their information security controls.

- Awareness Training: Employees must be trained to recognize and prevent cybersecurity threats, such as phishing attacks.

ISO 31000: Risk Management

- Risk Identification and Analysis: Insurers must identify potential risks, analyze their likelihood and impact, and document them in a risk register.

- Risk Treatment Plans: Organizations must develop and implement strategies to minimize or eliminate risks, including operational, financial, and compliance risks.

- Stakeholder Engagement: Insurers must involve stakeholders in the risk management process to ensure comprehensive coverage of risks.

- Monitoring and Review: Risk management processes must be continuously monitored and reviewed to adapt to changing conditions.

- Integration with Decision-Making: Risk management must be embedded in the organization’s decision-making processes at all levels.

ISO 22301: Business Continuity Management Systems (BCMS)

- Business Impact Analysis: Organizations must assess the potential impact of disruptions on their operations and prioritize critical functions.

- Continuity Plans: A documented business continuity plan (BCP) must be developed to guide the organization during emergencies.

- Resource Management: Organizations must ensure that necessary resources, such as personnel, technology, and facilities, are available to maintain critical functions.

- Incident Response: Insurers must establish procedures for responding to incidents, including communication protocols and recovery steps.

- Testing and Drills: Business continuity plans must be tested regularly through drills and simulations to ensure their effectiveness.

- Continuous Improvement: Lessons learned from disruptions and testing activities must be used to improve the BCMS.

ISO 14001: Environmental Management Systems (EMS)

- Environmental Policy: Organizations must establish a clear environmental policy that outlines their commitment to sustainability.

- Environmental Impact Assessment: Insurers must identify and assess the environmental impact of their operations, including energy use, waste generation, and resource consumption.

- Compliance with Regulations: Organizations must ensure compliance with environmental laws and regulations relevant to their operations.

- Resource Efficiency: Measures must be implemented to conserve resources such as electricity, paper, and water.

- Waste Management: Insurers must establish systems for reducing, reusing, and recycling waste.

- Environmental Objectives and Targets: Specific goals must be set to reduce the organization’s environmental footprint, and progress must be monitored regularly.

Meeting the requirements of ISO standards is essential for commercial motor vehicle insurers seeking to enhance quality & ensure compliance. Each standard has specific requirements tailored to address different aspects of operations, from quality management and risk mitigation to information security and environmental sustainability.

Achieving ISO certification demonstrates an organization’s commitment to excellence and customer satisfaction. By adhering to these requirements, insurers can build trust with clients, optimize processes, and stay ahead in a competitive market.

Call us at +91-8595603096 for a streamlined ISO certification process tailored to your organization’s needs. Let us make compliance simple and efficient for you!

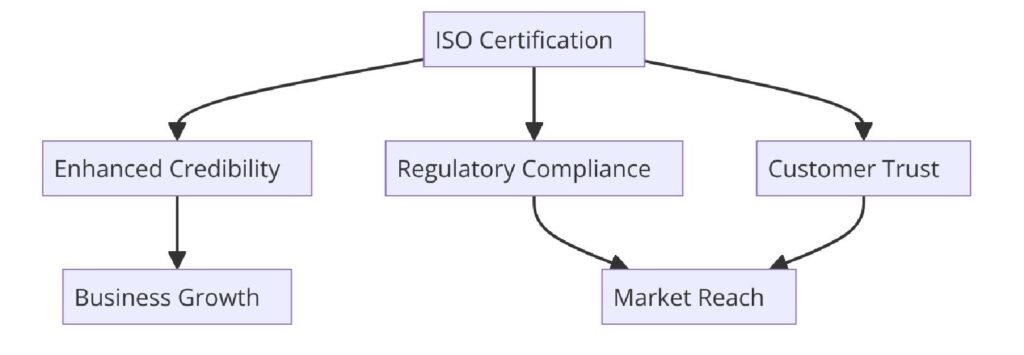

Benefits of ISO Certifications for Commercial Motor Vehicle Insurance Services

ISO certifications offer a multitude of benefits for organizations operating in the commercial motor vehicle insurance sector. Here are some of the key advantages:

Credibility and Reputation: Achieving ISO certification demonstrates your commitment to quality, security, and sustainability, which builds trust among clients and stakeholders.

Operational Efficiency: The structured frameworks provided by ISO standards help streamline processes, reduce redundancies, and improve overall efficiency.

Compliance: ISO certifications ensure that your organization complies with relevant laws and regulations, minimizing the risk of legal penalties or reputational damage.

Risk Management: With standards like ISO 31000 and ISO 22301, insurers can develop effective risk management strategies and enhance their ability to handle disruptions.

Customer Satisfaction: By adhering to ISO standards such as ISO 9001, insurers can provide consistent, high-quality services that meet customer expectations and improve satisfaction.

Competitive Advantage: ISO-certified organizations gain a competitive edge in the market, as clients and partners prefer working with companies that demonstrate a commitment to excellence.

Recognition: ISO certifications carry international credibility, helping organizations expand their operations and attract clients from different regions.

The commercial motor vehicle insurance industry is undergoing significant transformations in this year. A key trend is the integration of advanced technologies such as telematics, artificial intelligence, and blockchain to enhance risk assessment, claims processing, and fraud detection.

Industry reports show that the global commercial vehicle insurance market will grow at a CAGR of 6.5% between 2024 and 2030. Increasing demand for fleet-management solutions and the rise of electric vehicles (EVs) drive this growth and create new challenges and opportunities for insurers.

ISO certifications play a pivotal role in helping organizations navigate these changes by providing frameworks for innovation, security, and sustainability.

Contact Pacific Certifications today to start your journey toward compliance and excellence. Our expert auditors are here to guide you through the certification process and help your organization meet global standards.

Pacific Certifications holds ABIS accreditation. If you need support with ISO certification for your Commercial Motor Vehicle Insurance Services business, please contact us at support@pacificcert.com or +91-8595603096.

FAQs: ISO Certifications for Commercial Motor Vehicle Insurance Services

What are ISO certifications for commercial motor vehicle insurance services?

ISO certifications are globally recognized standards that establish best practices for quality, safety, risk management, and data security in the insurance sector.

Which ISO standards are most relevant for motor vehicle insurers?

Key standards include ISO 9001 (Quality Management), ISO 27001 (Information Security), ISO 31000 (Risk Management), and ISO 22301 (Business Continuity).

How does ISO 9001 benefit commercial motor vehicle insurance providers?

ISO 9001 ensures that insurers provide consistent, high-quality services, leading to improved customer satisfaction and operational efficiency.

Why is ISO 27001 important for insurance companies?

ISO 27001 helps organizations protect sensitive client data by implementing robust information security measures and managing cybersecurity risks.

Can Pacific Certifications assist with the ISO certification process?

Yes, Pacific Certifications provides auditing and certification services to help organizations achieve ISO compliance and recognition.

How do ISO standards improve customer satisfaction in the insurance sector?

By adhering to ISO standards, insurers can streamline processes, reduce errors, and deliver services that meet or exceed customer expectations.

Contact Us

If you need support with ISO certification for Commercial Motor Vehicle Insurance Services, contact us at support@pacificcert.com.

Read More at: Blogs by Pacific Certifications