What is PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards created to ensure that all organizations that handle cardholder data maintain a secure environment. Established by the Payment Card Industry Security Standards Council (PCI SSC), It aims to protect credit card information from theft and fraud by enforcing strict security measures.

It applies to any organization that stores, processes, or transmits cardholder data, including merchants, service providers, and financial institutions. Compliance with PCI DSS is not only a best practice but often a requirement for businesses that wish to accept credit or debit card payments.

For more information, contact us at support@pacificcert.com.

Purpose of PCI DSS

The purpose of PCI DSS is to safeguard sensitive payment card data by enforcing a set of security standards and practices. These standards help organizations prevent breaches of cardholder data, thus protecting both consumers and businesses from financial and reputational risks associated with data theft.

PCI DSS requires organizations to implement controls that ensure cardholder data is securely stored, processed, and transmitted. The goal is to reduce the likelihood of fraud, cyberattacks, and data breaches, while maintaining consumer confidence in the use of payment card systems.

Scope and Applicability

It applies to all organizations, regardless of size or location, that store, process, or transmit cardholder data or sensitive authentication data. PCI DSS applies to all organizations, regardless of size or location, that store, process, or transmit cardholder data. This includes merchants, service providers, payment processors and any other entity involved in handling payment card information. The standard applies across multiple industries, including retail, e-commerce, financial services, and healthcare, where payment card data is involved. Organizations that accept credit and debit card payments, either online or in physical stores, must comply with PCI DSS. Additionally, third-party vendors or service providers that handle cardholder data on behalf of merchants also need to comply. It is mandatory for businesses that wish to accept card payments, ensuring that they protect cardholder data and maintain a secure environment across all stages of the payment process.

The standard applies across multiple industries, including retail, e-commerce, finance, and healthcare, and includes any company that processes more than a minimal volume of cardholder data. Compliance is essential for all these entities to ensure that consumer data is protected and to avoid the risk of non-compliance penalties.

Key definitions

- Cardholder Data: Any information that identifies a cardholder, such as their name, primary account number (PAN), expiration date, and card verification value (CVV).

- Sensitive Authentication Data: Data related to card authentication, including PINs, passwords, and magnetic stripe data, which must never be stored after authorization.

- Merchant: A business or individual that accepts credit card payments in exchange for goods or services.

- Service Provider: A third party that processes, stores, or transmits cardholder data on behalf of merchants or financial institutions.

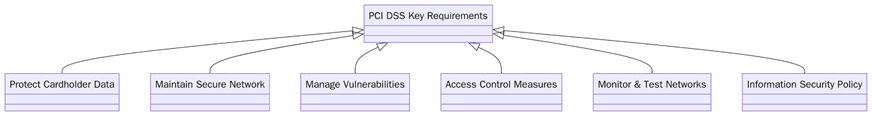

What are PCI DSS requirements?

There are 12 key requirements in PCI DSS that address various aspects of security, from securing networks to ensuring proper access control. These are broken down into six control objectives:

- Implement firewalls, routers, and other controls to protect cardholder data.

- Encrypt sensitive data during storage and transmission to prevent unauthorized access.

- Regularly update systems with patches, and use anti-virus or anti-malware software to protect against malicious software.

- Restrict access to cardholder data to only those employees who need it to perform their job duties.

- implement logging and monitoring systems to track access and detect security breaches.

- Develop, maintain, and enforce an internal policy to ensure the security of cardholder data.

What are the benefits of PCI DSS Compliance?

Achieving PCI DSS compliance offers numerous benefits, particularly for businesses involved in card payment transactions. Below are some of the key advantages of being PCI DSS compliant:

- Compliance helps protect your business and customers from data breaches, fraud, and other cyberattacks.

- By adhering to PCI DSS standards, your customers can feel confident that their payment information is being handled securely.

- Compliance with PCI DSS can reduce the risk of fines, penalties, and legal fees associated with non-compliance or data breaches.

- Being PCI DSS compliant can differentiate your business from competitors who may not adhere to these security standards, making your company more attractive to customers.

- Many markets and payment processors require PCI DSS compliance for businesses involved in card transactions, allowing you to access a broader market.

The demand for PCI DSS compliance is increasing as cyber threats grow, especially with the rise of e-commerce and mobile payments. With new technologies like contactless payments and digital wallets, businesses are adopting new measures to ensure the security of payment data. In response to the increasing complexity of security threats, PCI SSC continues to update the PCI DSS standards, requiring businesses to implement more advanced encryption methods and improve monitoring practices. As cyberattacks increase globally, the demand for PCI DSS compliance will continue to rise. In the upcoming years, businesses across the world will face more stringent security regulations, with organizations in emerging markets adopting its standards to meet the global demand for secure card transactions. With the digitization of payments and the global expansion of e-commerce, its compliance will become a necessity for businesses in both developed and emerging markets.

Certification Process for PCI DSS

The certification process involves the following steps:

- Determine Scope: Identify all systems involved in the storage, processing, or transmission of cardholder data.

- Complete Self-Assessment: Small to medium-sized businesses can conduct a Self-Assessment Questionnaire (SAQ) to evaluate compliance.

- Conduct a PCI DSS Audit: Larger organizations must undergo a formal audit by a Qualified Security Assessor (QSA) to verify compliance.

- Submit Documentation: After passing the audit or self-assessment, submit your documentation to the acquiring bank or card brand.

- Receive Certification: Upon successful evaluation, your business will be certified as PCI DSS compliant.

- Maintain Compliance: Ongoing monitoring, updates, and audits are required to maintain PCI DSS compliance.

Timeline for PCI DSS Compliance

The typical timeline for PCI DSS compliance varies depending on the organization’s size and complexity.

Initial Assessment takes 1-2 months to assess the systems involved and identify potential gaps in security. Self-Assessment or External Audit occurs in 1-2 months to complete the self-assessment or hire a QSA for the audit. Implement Security Measures takes 3-6 months to implement necessary security measures to meet PCI DSS requirements. Submission and Certification takes 1-2 months for submission of documentation and final certification from the acquiring bank.

How much does PCI DSS Certification cost?

PCI DSS certification cost depends on several factors, including the size and complexity of the organization, the number of systems involved, and the need for a QSA. Typical costs include:

Audit Fee is the Fee for the certification body’s audit process. Training costs are the costs for educating staff on GDP Certification and the necessary processes for compliance. Ongoing maintenance are the costs for regular audits and recertification required every 3 years.

How Pacific Certifications Can Help?

At Pacific Certifications, we provide an overreaching auditing and certification services for PCI DSS compliance. Our team will guide you through the entire certification process, ensuring that your organization meets all required security standards. Our services include:

- Stage 1 and Stage 2 audits to evaluate your security processes and ensure compliance.

- Objective conformity assessments based on its standards.

- Certification issuance upon successful completion of the audit.

- Ongoing surveillance audits to ensure continued PCI DSS compliance.

For audits and certification, contact support@pacificcert.com.

PCI DSS Training and Courses

Various training courses are available to help organizations comply with PCI DSS, including:

- Lead Auditor Training – Equips professionals to conduct external third-party audits.

- Lead Implementer Training – For those responsible for planning and executing ISO 9001 implementation.

- Internal Auditor Training – Preparing internal auditors for certification audits

Pacific Certifications provides accredited training programs. If your organization is looking for PCI DSS training, our team is equipped to help you. Contact us at support@pacificcert.com.

FAQ

How long does it take to get PCI DSS certification?

The certification process typically takes 3–6 months, depending on your organization’s preparedness and audit outcomes.

Is PCI DSS certification mandatory for all businesses?

PCI DSS certification is mandatory for any business that stores, processes, or transmits payment card information.

What are the main benefits of PCI DSS certification?

Certification helps reduce the risk of data breaches, improves consumer trust, ensures regulatory compliance, and provides a competitive advantage.

Can I apply for PCI DSS certification without a security management system in place?

No, businesses must have a strong security management system and adhere to PCI DSS requirements before applying for certification.

How often do I need to renew PCI DSS certification?

PCI DSS certification must be renewed annually, with regular audits and security checks required throughout the year.

Ready to get certified?

Contact Pacific Certifications to begin your certification journey today!

Suggested Certifications –

Read more: Pacific Blogs